401k to roth ira tax calculator

The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be. 401k Withdrawing money from a 401k early comes with a 10 penalty.

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

It shares certain similarities with a traditional 401k and a Roth IRA although there are important.

. FAQ Bitcoin In the Solo 401k. You can use our IRA Contribution Calculator or our Roth vs. Converting to a Roth IRA may ultimately help you save money on income taxes.

If you return the cash to your IRA within 3 years you will not owe the tax payment. Find out how much you can contribute to your Solo 401k with our free contribution calculator. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears.

Since you invest in your Roth IRA with money thats already been taxed the money inside the account grows tax-free and you wont pay a dime in taxes when you withdraw your money at retirement. Keep in mind that while there are no income limitations to contribute to a Traditional IRA you are not eligible for a Roth IRA if your income level is too high. Money in a traditional 401k or IRA grows tax deferred meaning that you pay taxes on the money when you withdraw the funds and no taxes at all when you invest the money.

401k Plans for Small Businesses Publication 4222 DOL website PDF. A Roth 401k gives you a similar tax me once advantage except that you get taxed at the beginning rather than the end. 401k traditional IRA or Roth IRA.

It is named after subsection 401k in the Internal Revenue Code which was made possible by the Revenue Act of 1978. Retirement Plans for Self-Employed People. Owner partners and spouses have several options for tax-advantaged savings.

Do it yourself retirement planning. Related Retirement Calculator Roth IRA Calculator Annuity Payout Calculator. See the Roth IRA article for more.

A Roth 401k is an account funded with after-tax contributions. You can also use the Roth Conversion Calculator to get ideas for how much to convert this year. A 401k is a form of retirement savings plan in the US.

What is the after tax impact of switching from a traditional IRA to a Roth IRA. As your income increases the amount you can contribute gradually decreases to zero. This IRS 401k document gives a brief overview with links.

A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required.

Here are some advantages a Roth IRA has over a 401k. Simple 401k Calculator Terms Definitions. 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code.

Traditional IRA comparison page to see what option might be right for you. As soon as those 60 days are up the money from the IRA is considered to be cashed out. Roth IRAs have a lot of benefits like tax-free withdrawals in retirement.

Traditional 401ks allow pre-tax contributions taxable withdrawals. Roth IRAs have income limits. Save on taxes and build for a bigger retirment.

IRA or Roth IRA. Traditional IRA or call us at 866-855-5635 for help. And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from.

A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. Retirement Plans for Small Entities and Self-employed. Required minimum distributions RMDs Most owners of traditional IRAs and employer-sponsored retirement plan accounts like 401ks and 403bs must withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020.

Decide if you want to manage the investments in your IRA or have us do it for you. 401K and other retirement plans. Other types of plans.

Heres how to choose between a Roth IRA and a Traditional IRA Jump ahead for more tips on choosing between an IRA and a 401k. And they dont force you to take mandatory withdrawals from your retirement savings later in life like 401ks do. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

Unlike a 401k you contribute to a Roth IRA with after-tax money. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. If you are asking if you can take a distribution non-conversion from the Roth solo 401k that was funded through the conversion of solo 401k voluntary after-tax contributions instead of transferring the funds to a Roth IRA yes you can provided you have both had the Roth solo 401k for 5 years and have reached age 59 12.

Learn more about the differences between a Roth vs. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Penalty Relief Program for Form 5500-EZ filers - file your delinquent returns for a reduced fee.

With tax benefits that are mainly available through an employer. Heres more on the pros and cons of the IRA vs. Grow Crypto Gains Tax Free with Roth 401k.

A Solo 401k plan a SEP IRA a SIMPLE. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account.

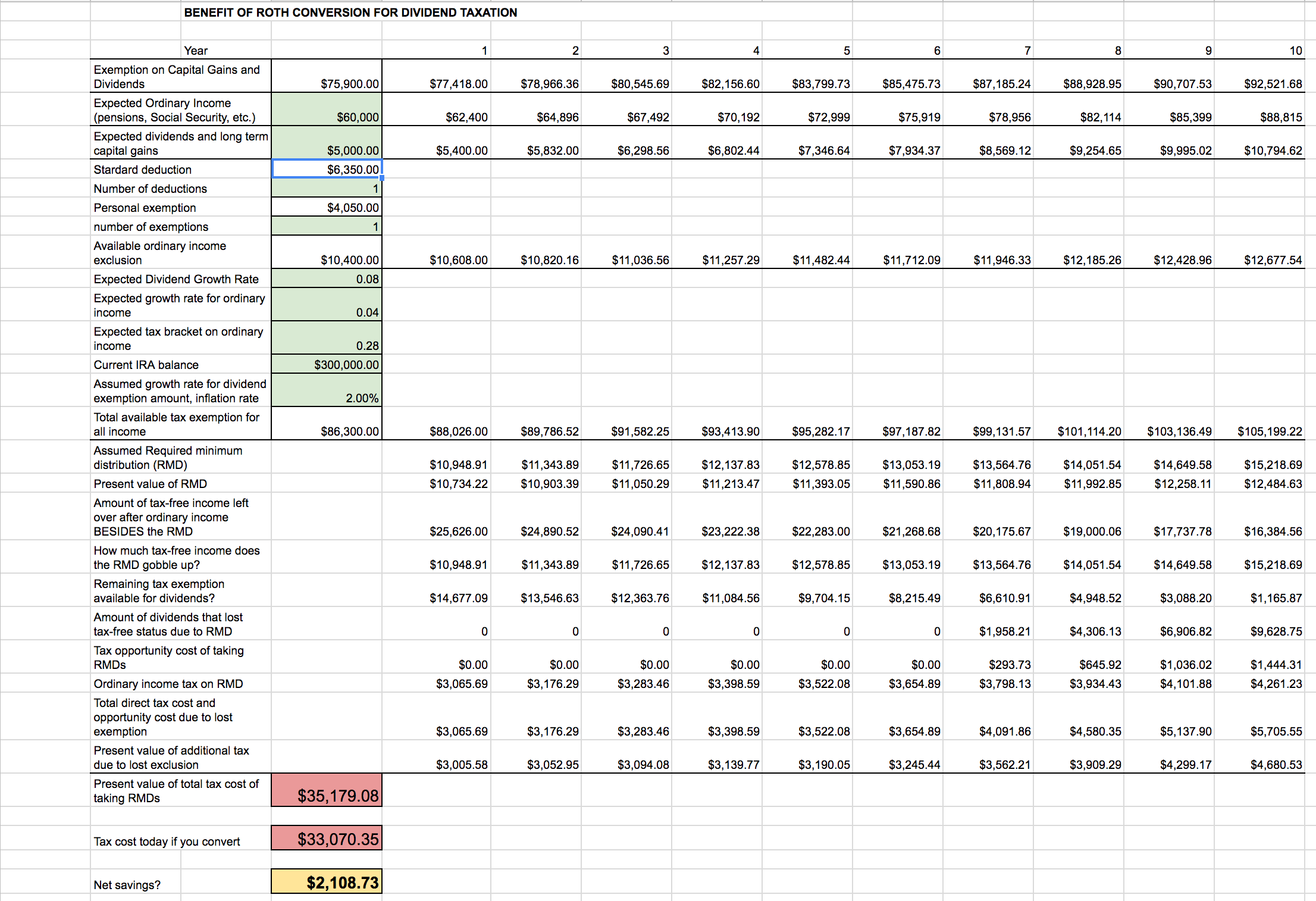

Roth Ira Conversion Calculator Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Systematic Partial Roth Conversions Recharacterizations

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Spreadsheet Seeking Alpha

Traditional Vs Roth Ira Calculator

Roth 401k Roth Vs Traditional 401k Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Excel Template For Free

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Ultimate Roth 401 K Guide District Capital Management

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Is It Worth Doing A Backdoor Roth Ira Pros And Cons